Meridian LMS provides financial institutions with the tools to manage regulatory compliance, deliver professional development training, and ensure employees remain current with industry standards. From anti-money laundering (AML) training to certifications in financial regulations, our LMS helps financial services organizations mitigate risk, enhance skills, and improve operational efficiency.

The financial services industry is subject to stringent regulations, and ensuring compliance is critical to avoid legal risks, fines, and operational disruptions. Meridian LMS provides financial organizations with a centralized platform to manage compliance training, track certifications, and ensure employees stay up to date with AML, KYC, GDPR, and other crucial regulations.

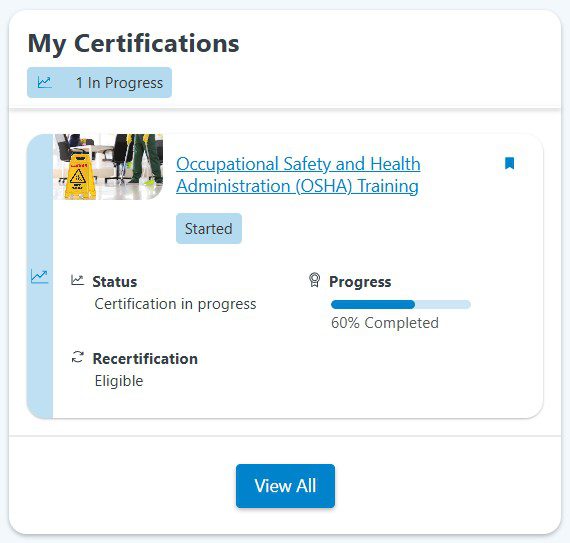

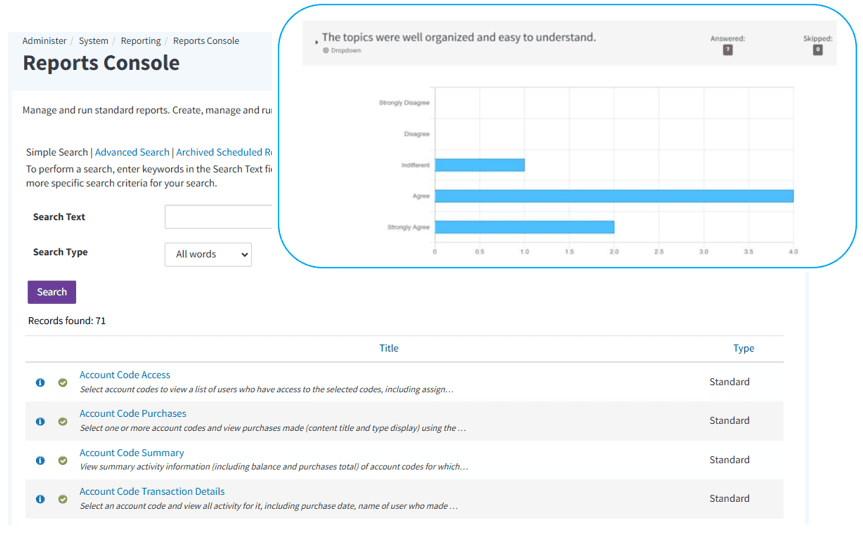

Our LMS automates compliance training delivery, tracks progress, and provides detailed reporting, making it easy to ensure all employees adhere to required financial regulations.

Quickly update training content to reflect new regulations and industry standards.

Robust security features ensure compliance with data protection laws.

Provide consistent training with flexible formats for all learners.

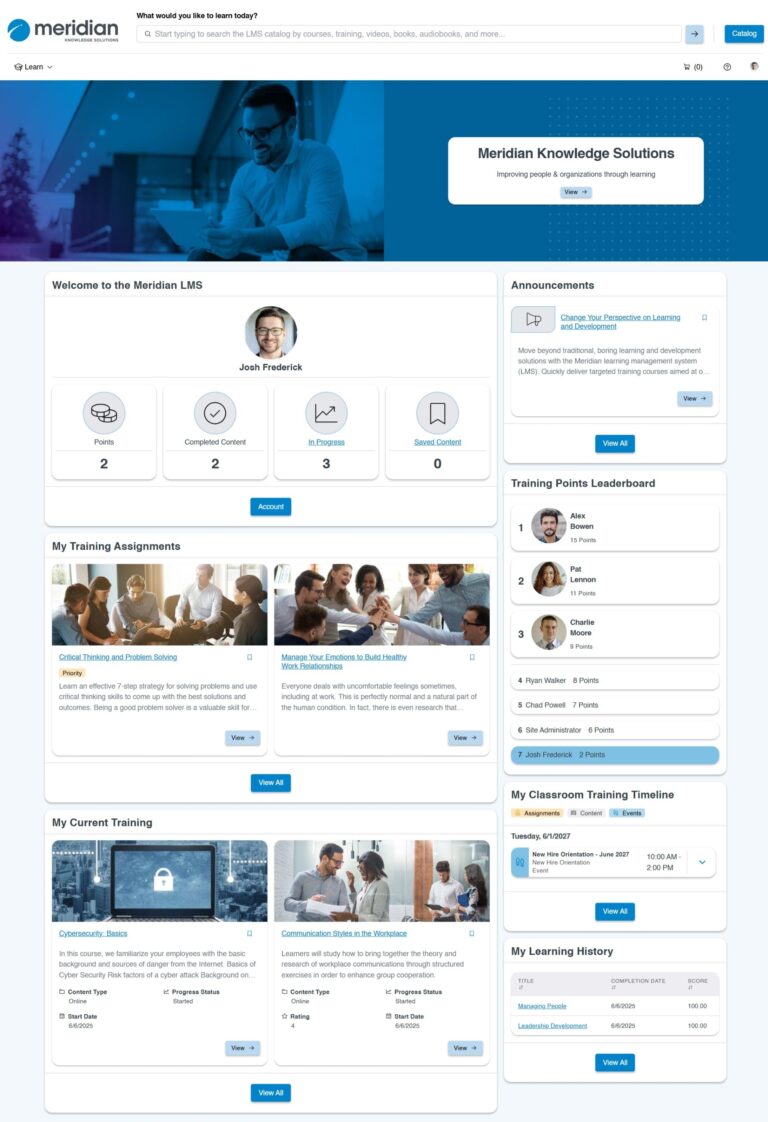

Utilize interactive content, gamification, and personalized learning paths to improve engagement.

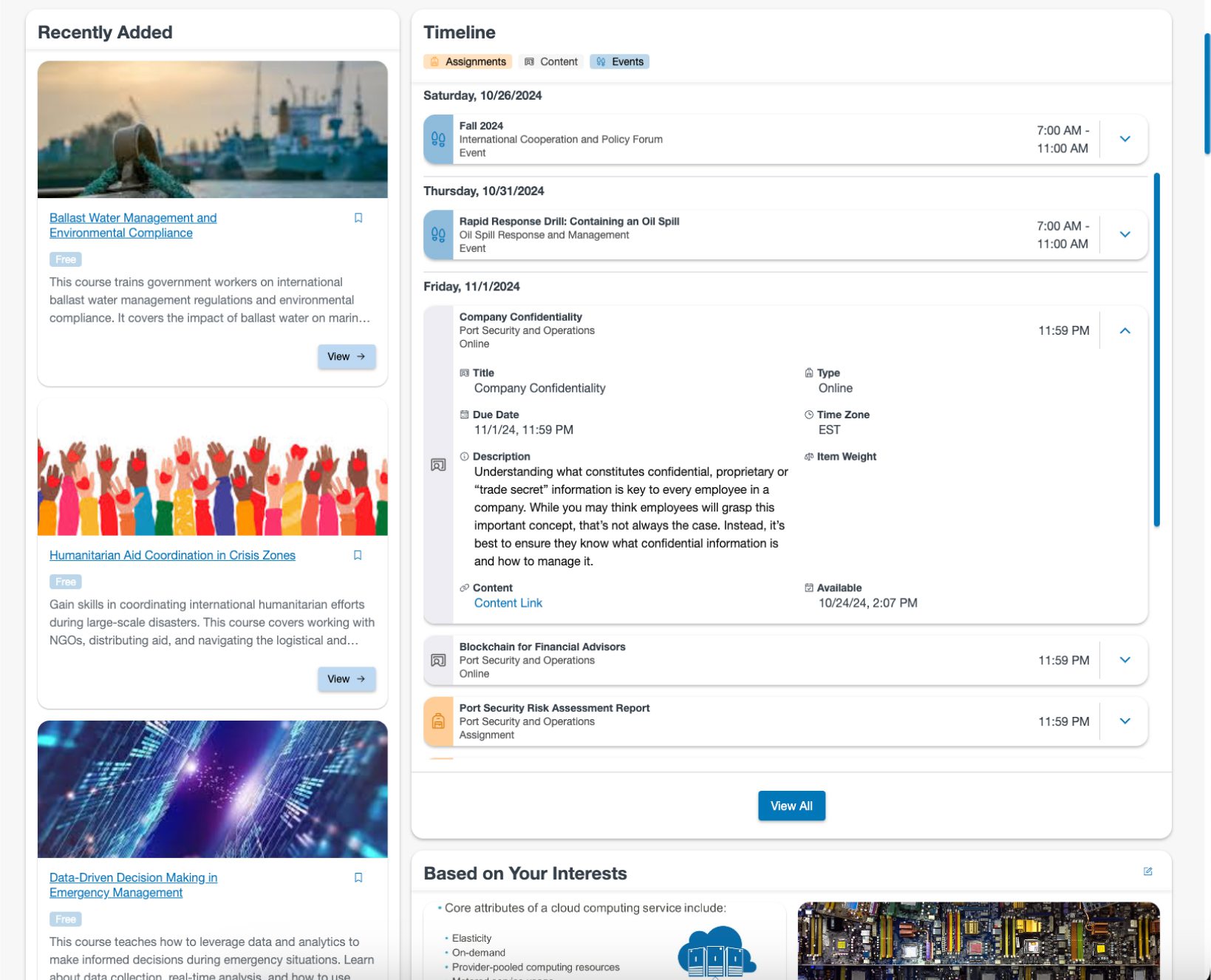

Financial institutions operate in a landscape of regulatory complexity and market volatility. Meridian LMS helps mitigate these risks by enabling organizations to deliver specialized training through external content providers and by tracking employee certifications to ensure compliance. This approach reduces the likelihood of errors, penalties, and reputational damage by ensuring employees stay aligned with industry regulations and best practices.

The financial industry demands continuous professional development in addition to compliance. Meridian LMS supports financial organizations by providing employees with ongoing learning opportunities to improve their skills, gain certifications, and stay competitive in a fast-evolving industry.

Whether leadership development, financial product training, or client relationship management, Meridian LMS helps financial institutions upskill their workforce and promote career growth.

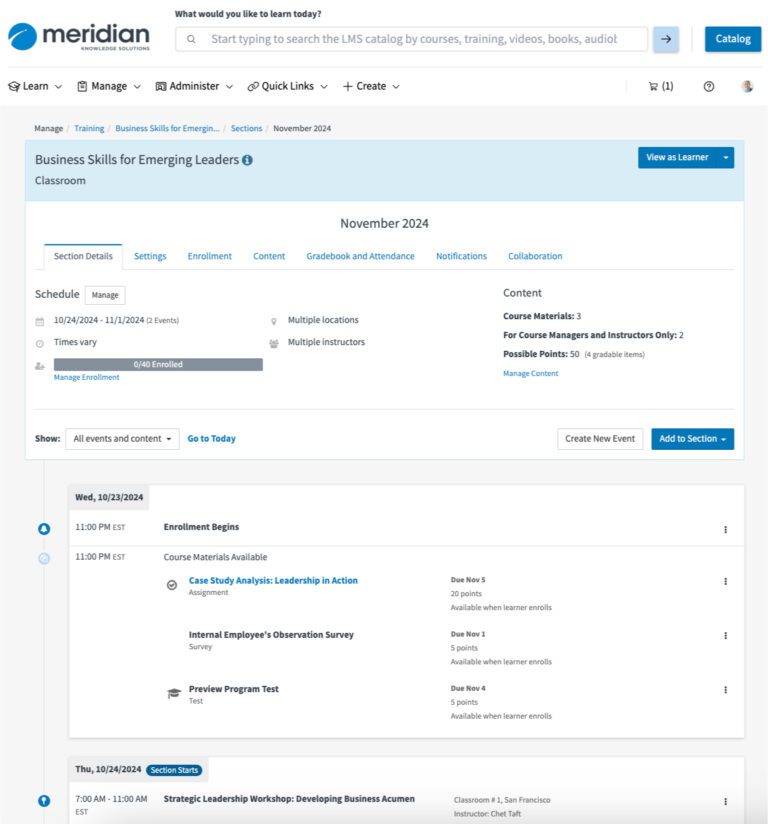

Combine online, in-person, and hybrid learning formats to provide flexible experiences. Meridian LMS supports blended sessions where participants can engage in the same event—some attending in person with an instructor and others joining online—enhancing flexibility and inclusivity.

Automate and manage compliance training, track certifications, and generate audit-ready reports.

Protect sensitive information with robust security protocols and compliance with data protection regulations.

Seamlessly integrate with existing HR systems and other software for streamlined operations.

Gain insights into workforce development with real-time reporting and analytics.

Create distinct learning environments for different departments or teams managed centrally.

Meridian LMS automates the assignment and tracking of mandatory compliance training and certifications. With real-time reporting and audit-ready documentation, financial institutions can ensure all employees remain compliant with regulations set by authorities like FINRA, SEC, and CFPB. Automated reminders help prevent certification lapses, reduce legal risks, and enhance operational efficiency.

Meridian LMS offers multi-domain management, allowing you to create distinct learning environments for regions, departments, or business units under one centralized system. This ensures consistent training delivery while catering to each area's specific needs.

Meridian LMS helps overcome challenges like stringent regulations, evolving industry trends, and dispersed workforces by providing:

Yes, Meridian LMS employs robust security measures, including data encryption, secure user authentication, and compliance with data protection regulations like GDPR. This ensures that sensitive information remains protected against unauthorized access.

Yes, Meridian LMS is mobile-friendly. It allows employees to access training materials anytime, anywhere, using smartphones or tablets. This is especially beneficial for professionals who travel frequently or work remotely.